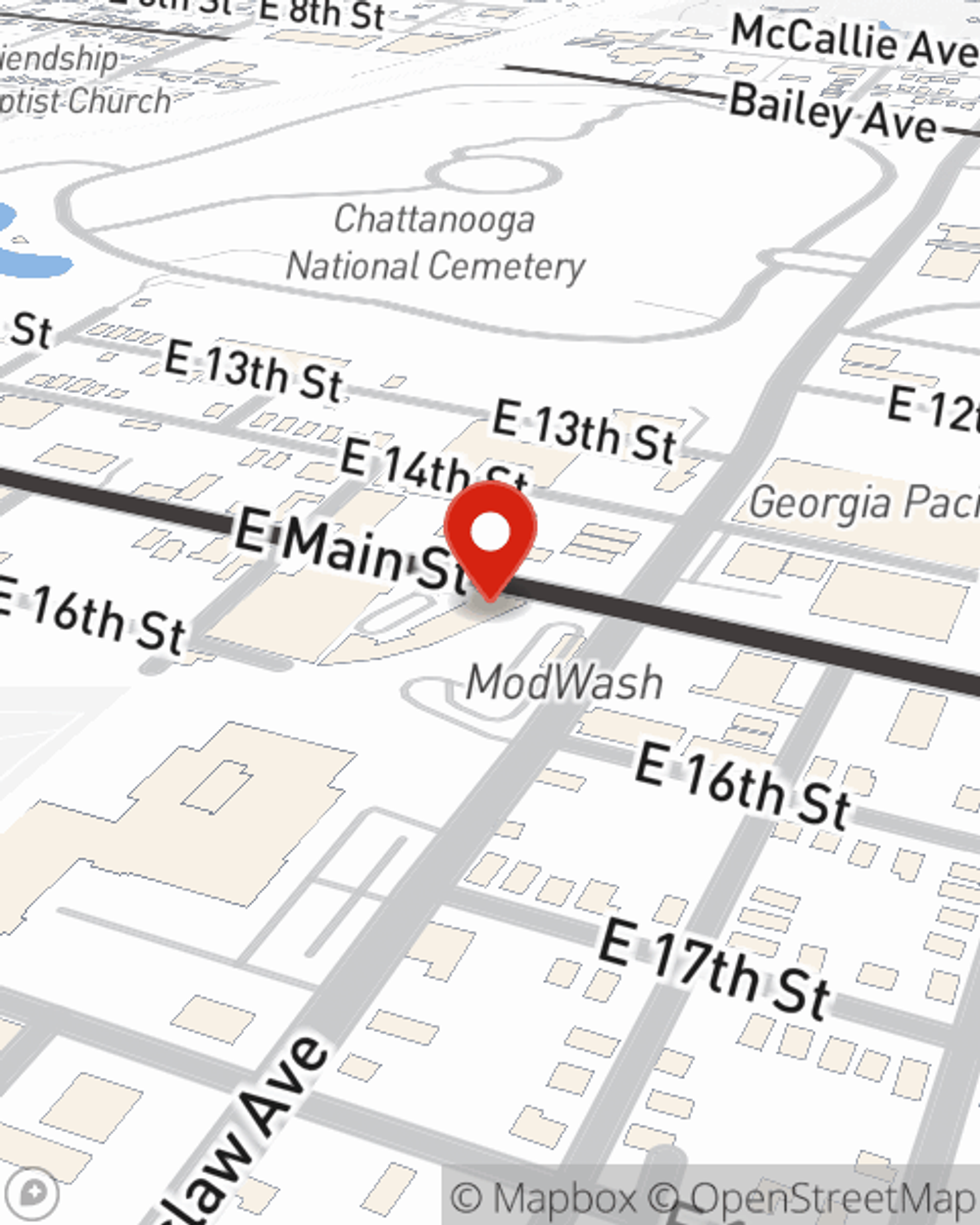

Condo Insurance in and around Chattanooga

Townhome owners of Chattanooga, State Farm has you covered.

Cover your home, wisely

- Hamilton County

- Chattanooga, TN

- Bradley County

- Rossville, GA

- Lookout Mountain, TN

- St. Elmo, TN

- Signal Mountain, TN

- Ootlewah, TN

- Cleveland, TN

- Athens, TN

- North Georgia

- Southeast Tennessee

- Northshore

- Southside

- Walker County

- Hixson, TN

- Soddy Daisy, TN

- East Ridge, TN

- Red Bank, TN

There’s No Place Like Home

When it's time to catch your breath, the retreat that comes to mind for you and your family and friendsis your condo.

Townhome owners of Chattanooga, State Farm has you covered.

Cover your home, wisely

Why Condo Owners In Chattanooga Choose State Farm

You want to protect that special place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as fire, vehicles or weight of ice or snow. Agent Hank DeHart can help you figure out how much of this great coverage you need and create a policy that works for you.

Don’t let worries about your condo make you unsettled! Contact State Farm Agent Hank DeHart today and learn more about how you can meet your needs with State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Hank at (423) 777-5300 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Hank DeHart

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.